are delinquent property taxes public record

How Do Doordash Drivers Pay Taxes. The tax on the property is auctioned in open competitive bidding based on the least percent of interest to be received by the investor.

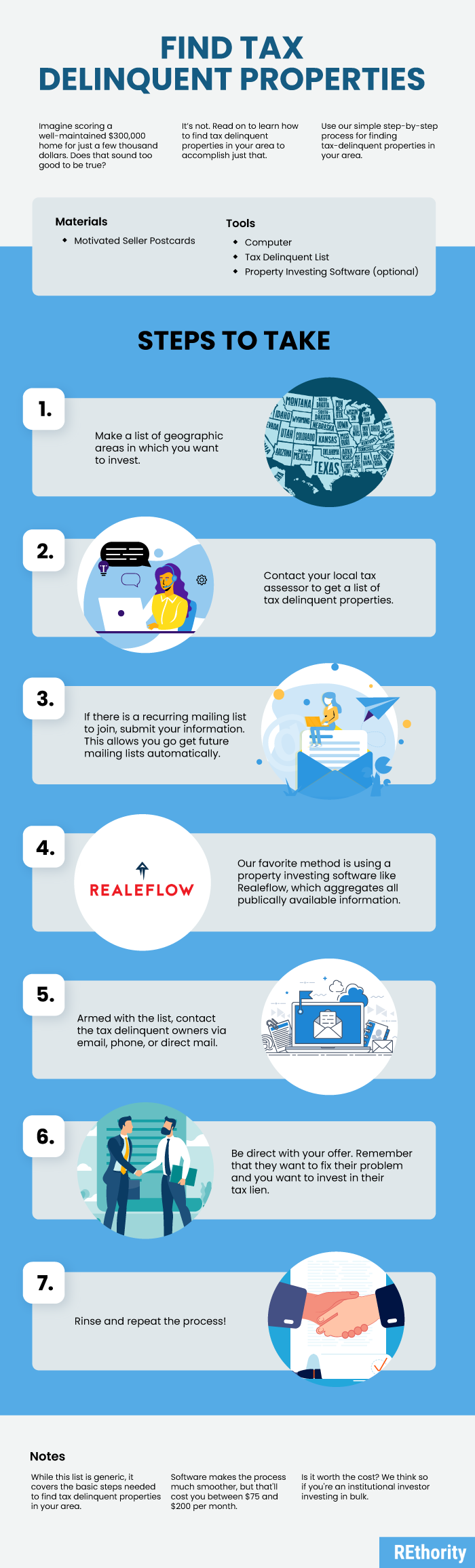

How To Find Tax Delinquent Properties In Your Area Rethority

If you need confirmation of the 2021 payment please email your request to taxdepartmentseminolecountytax including your name parcel or tax bill number and the address of the property.

. 105-3651 b 1. If your unpaid taxes have been sold at an annual tax sale scavenger sale or over the counter the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount necessary to redeem pay your taxes and remove the threat of losing your property. It is recommended that a tax claims search be conducted in the same time period as a real estate closing to minimize any potential problems or miscalculations.

If the property owner fails to pay the delinquent taxes within two years from the date of delinquency the tax certificate holder may file a Tax Deed Application TDA per Florida Statute 197502. The objection must be filed by April. Prior to current year delinquent taxes being put in the delinquent records of the County Treasurer they are published in a county newspaper of general circulation for 3 consecutive weeks in August in accordance with the provisions of KSA.

The TDA is a legal document that initiates the process of the property to be sold at a tax deed sale conducted by the Clerk Comptrollers Office. When delinquent or unpaid taxes are sold by the Cook County Treasurers office at an annual sale or scavenger sale the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount necessary to redeem pay your taxes and remove the threat of losing your property. A lien is defined as a charge on real or personal property for the satisfaction of debt or duty.

If a legal claim is made against your property in order to satisfy a tax debt the IRS will file a Notice of Federal Tax Lien. Whats more the tax office must advertise delinquent tax liens in the name of the January 6 record owners and not in the name of prior owners. In addition this department collects annual sewer fees.

Interest begins to accrue on the total due at the rate of 1 per month. 9 am4 pm Monday through Friday. Ad The Ultimate Solution for Property Investors Realtors Mortgage Brokers.

On June 7 2021 the first Monday in June a certificate will be issued authorizing the county treasurer as trustee for the State and county to hold each property. Delinquent Taxes and Tax Foreclosure Auctions. Publication of Delinquent Personal Property Taxes.

Delinquent tax records are handled differently by state. Even emails marked private however may be subject to public disclosure under public records requirements including the Colorado Open Records Act CORA with limited. View information about Albany County real property auctions and county-owned property sales including list of properties.

Are Irs Tax Liens Public Record. A prior owner who was not the record owner as of January 6 may not be held personally responsible for taxes on the real property in question. Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089.

Delinquent Taxpayers over 5000 Top 100 List About Us. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Find All The Record Information You Need Here.

The Tax Collectors office is responsible for collecting taxes for the Township of Piscataway Middlesex County the Piscataway School Board and the Piscataway fire districts. Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089. Propstream Alone Has Helped My Real Estate Investment Business Scale Jerome C.

Our property records tool can return a variety of information about your property that affect your property tax. Whats more the tax office must advertise delinquent tax liens in the name of the January 6 record owners and not in the name of prior owners. This list is published to inform all persons that the listed property is subject to forfeiture because of delinquent taxes.

Tax Department Call DOR Contact Tax Department at 617 887-6367. Typically a tax lien is placed on the property by the government when the owner fails to pay the property taxes. 105-3651 b 1.

Instantly Find and Download Legal Forms Drafted by Attorneys for Your State. They are then known as a certificate of delinquency and represent a lien against the property in question. Eventually the lien owners may have to force foreclosure on the property to pay the liens.

In other words if delinquent property taxes are paid off while property is in a tax deed application status the applicant is. Delinquent Property Tax Search. To pay delinquent property taxes in person visit the Tax Claim office at the Erie County Courthouse 140 West Sixth Street Room 110.

Mail all documentation to. 1 S Main 2nd Floor Mount Clemens MI 48043. If payment is not received or United States Postal Service USPS postmarked by June 30 on July 1 a 15 redemption fee will be.

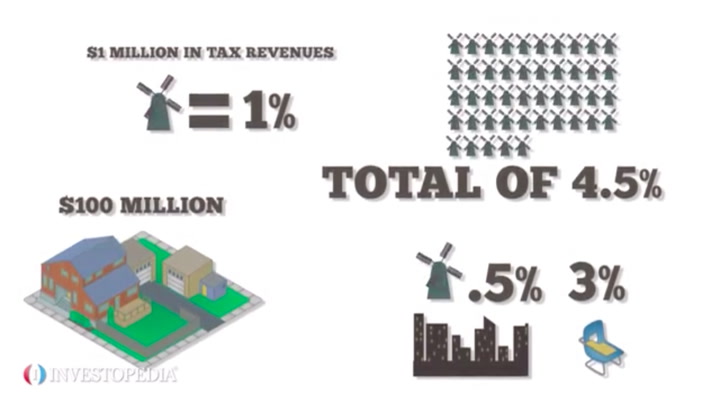

The Tax Lien Sale provides for the payment of delinquent property taxes by an investor. You may also contact us directly at 407-665-7636. 112 State Street Room 800 Albany NY 12207.

The property owner taxpayer or other interested persons must either pay the tax and penalty plus interest and costs or file a written objection with the District Court Administrator. Property taxes officially become delinquent on June 16 this year. Pay Real Property Taxes.

Use our free New York property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. For information on taxes or sewer billings please contact the Tax Collection Office at 732 562-2331. The list includes the parcel number the name of the owner of record and the amount of taxes penalties interest and costs due.

View the tax delinquents list online. For payments postmarked after each deadline date delinquent interest must be included with your payment. Are delinquent taxes public record.

The Department of Revenue files a lien with the county Prothonotary Office when an individual or business has unpaid delinquent taxes. New York residents can find NY property tax records by collating accurate information about a property and taking it to their local county tax commission. If the amount due is not paid by 500 pm.

Are delinquent taxes public record Wednesday June 8 2022 Edit. Notice of Delinquency - The Notice of Delinquency in accordance with California Revenue and Taxation Code Section 2621 reminds taxpayers that their property taxes are delinquent and will default on July 1. At the close of business on April 15th the tax bills are transferred from the sheriffs office to the county clerks office.

Property taxes that are delinquent at the end of December are added to any previously uncollected taxes on a parcel for. Contact for View the Public Disclosure Tax Delinquents List. A prior owner who was not the record owner as of January 6 may not be held personally responsible for taxes on the real property in question.

This affects the ability to display the 2021 tax payments on our website. Ad Unsure Of The Value Of Your Property. If left unpaid the liens are sold at auctions to the public.

Whats more the tax office must advertise delinquent tax liens in the name of the January 6 record owners and not in the name of prior owners. The Clerks office also provides calculations of delinquent taxes owed. When a lien is filed it becomes a matter of public record.

Unsecured Property Tax Los Angeles County Property Tax Portal

Frequently Asked Questions Property Taxes City Of Courtenay

Secured Property Taxes Treasurer Tax Collector

Frequently Asked Questions Property Taxes City Of Courtenay

How To Find Tax Delinquent Properties In Your Area Rethority

Property Taxes Town Of Gibsons

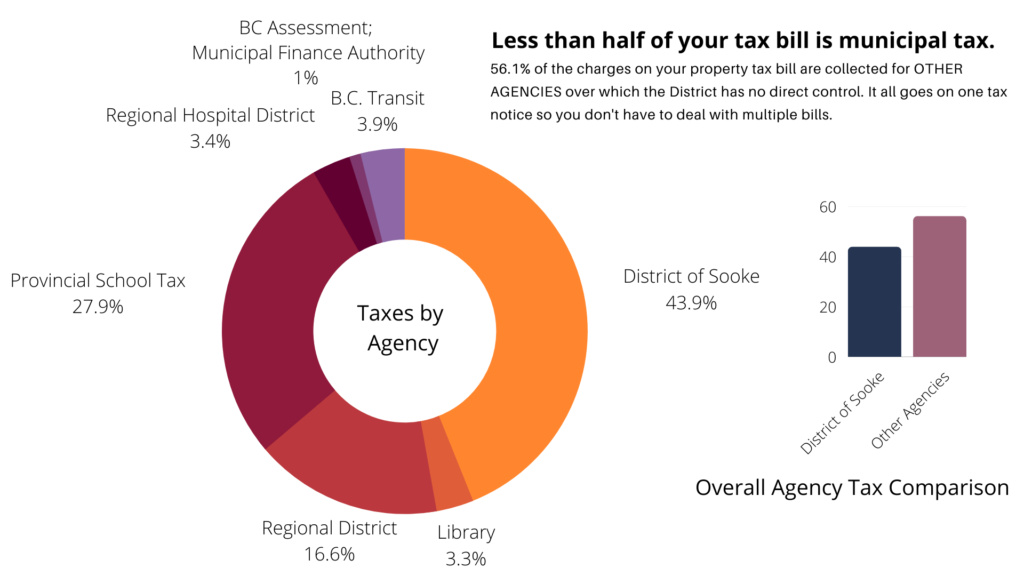

Overview Of Sechelt Property Taxes

One Of The Steps In Buying A Home Is To Have A Title Search Completed Prior To Closing Many First Time Buyers May Not Have H Title Insurance Title Home Buying

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

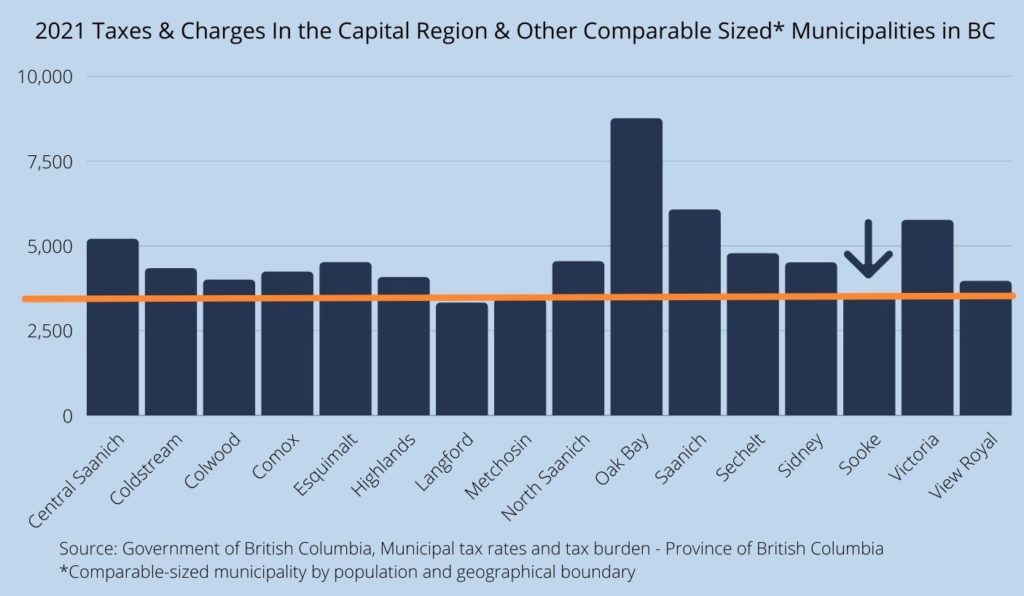

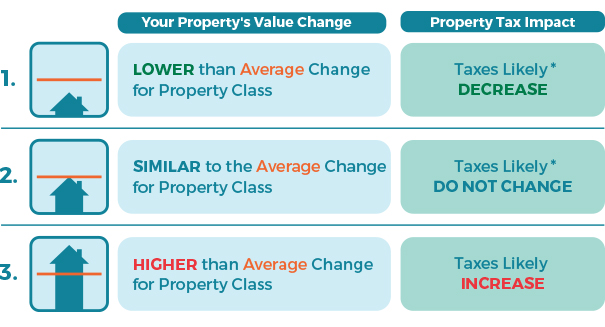

How Property Taxes Are Calculated