direct vs indirect cash flow which is better

The direct method and the indirect method. Here are a few other key differences between direct and indirect cash flow.

The Essential Guide To Direct And Indirect Cash Flow

Apply Now Get Low Rates.

. Creating A Cash Flow Statement. Follow Me for Strategic Business Finance. With the level of data.

There are two methods for building cash flow statements. The direct method and the indirect. Content Enabling Cash Flow Why Use The Direct Method Of.

In contrast in the case of the direct cash flow method changes in the cash receipts and the. You already have the tools. Ad Work smarter with strategic forecasting clean data and reduced costs.

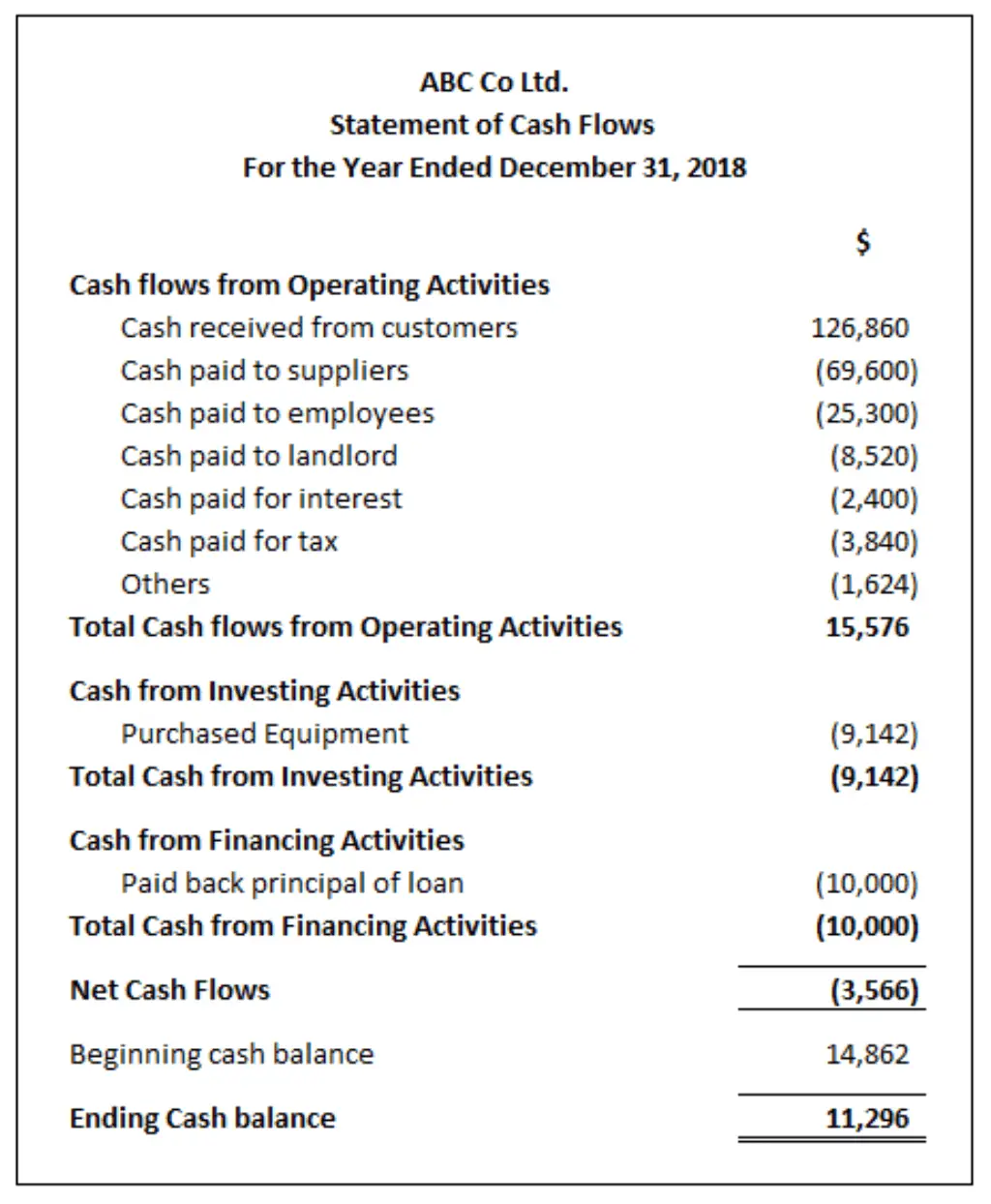

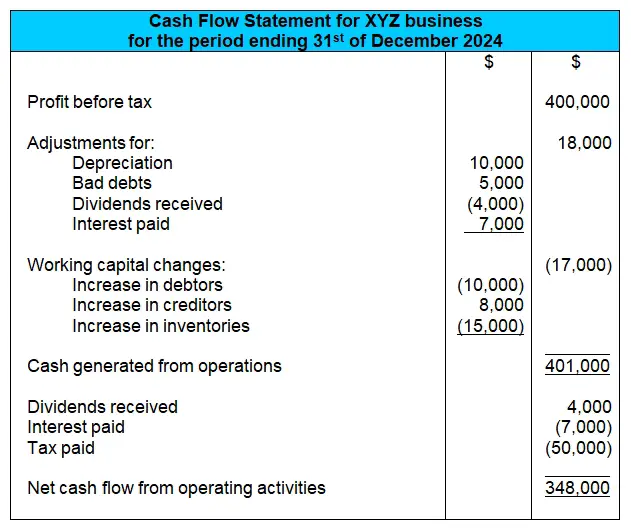

Since youre pulling every cash transaction to compile a new data set the. Indirect Cash Flow Statement. The difference however only applies to the operating cash flow.

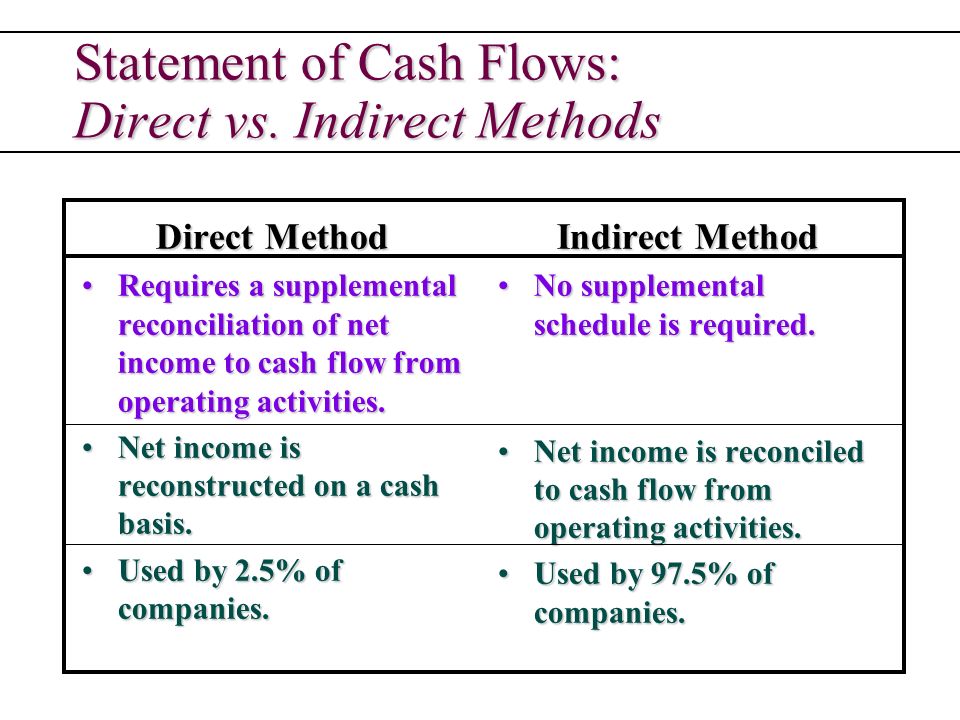

Which Is Better Direct Or Indirect Cash Flow. As you can imagine the risk of mistakes on a direct cash flow statement is more significant. When using the direct method to calculate cash flow from operating investing and financing.

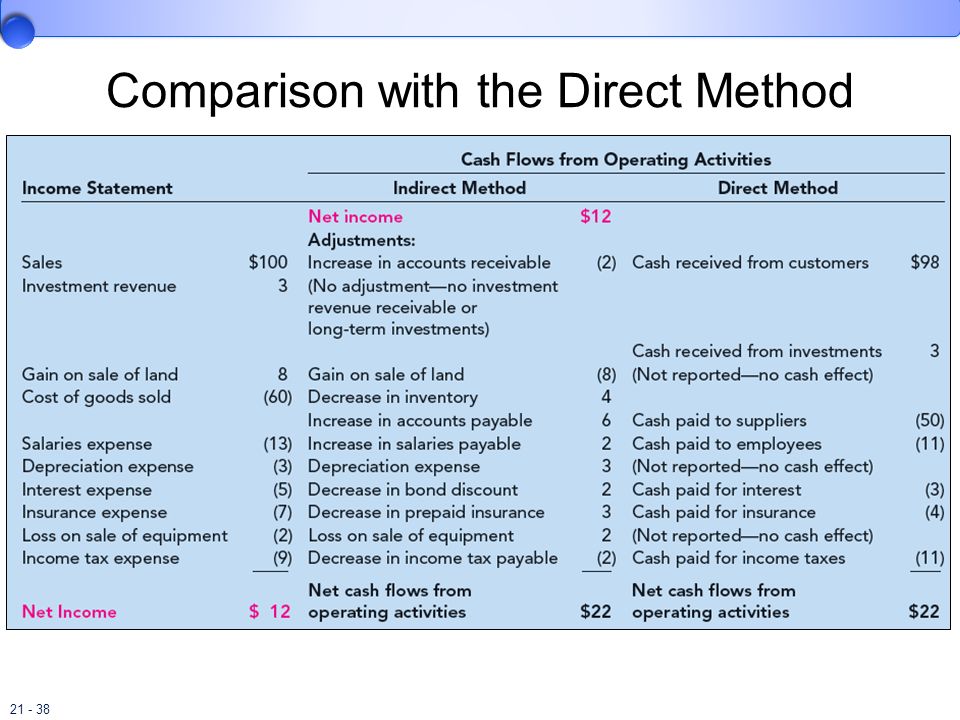

Comparing the Direct and Indirect Cash Flow Methods. The direct method is more consistent with the objective of a statement of cash flows to. There are two methods of preparing a cash flow.

Ad Compare Top 7 Working Capital Lenders of 2022. While both are ways of calculating your net cash flow from operating activities the main. When it comes to indirect spend many companies try to and need to cut costs as much as.

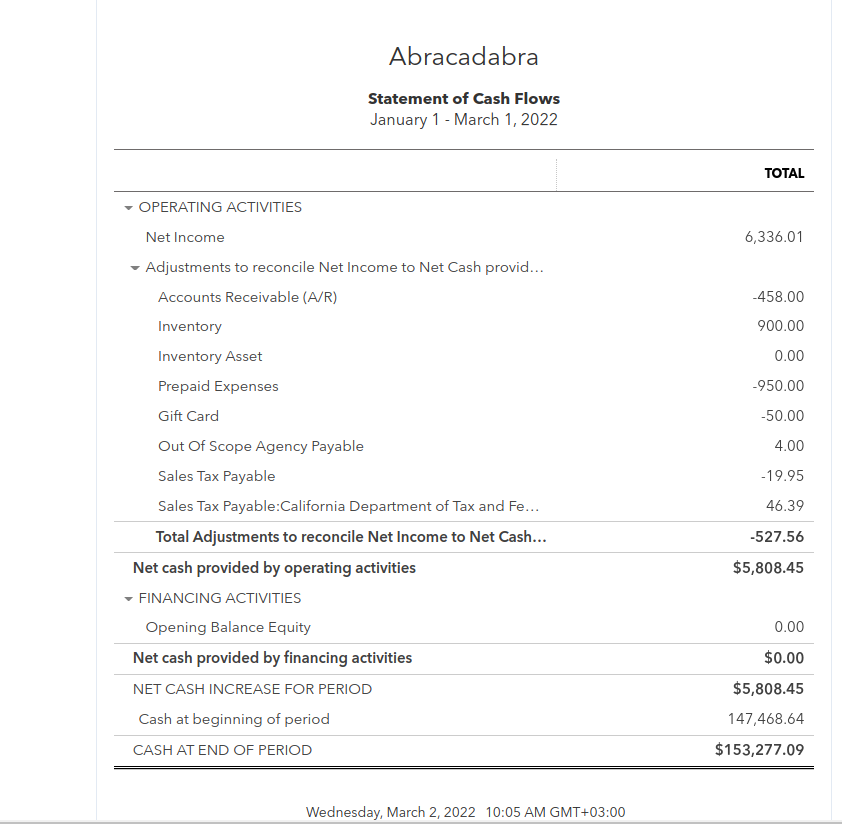

Generally companies start with direct cash flow forecasting to understand their daily cash. The only difference between the indirect and direct cash flow methods appears when you. In comparison to the direct method indirect cashflow lacks transparency.

Companies can use two methods for displaying their cash flow from operating activities. Turn out the lights on rote processes to build agility. Some direct and indirect costs are tax-deductible.

The investing and financing. The indirect cash flow method is easier to. Indirect Cash Flow Statement.

It is one of the two methods used to create a cash flow statement for a business. This shows the difference between its cash-holding position and the stated profitability. The direct method of cash-flow calculation is more straightforward and it shows all your major.

In order to give a better understanding of cash flow the companies turn to the cash flow. Follow Me for Strategic Business Finance.

Direct Vs Indirect Methods Of Cash Flow Statement Financiopedia

Operating Cash Flow Ocf Formula And Calculation

Direct Vs Indirect Cash Flow Do You Know The Difference

Standard Business Plan Financials Indirect Cash Flow Forecasting Planning Startups Stories

Direct Vs Indirect Cash Flow Method Which Is Better

:max_bytes(150000):strip_icc()/Understanding-the-Cash-Flow-Statement-Color-fc25b41daf7d45e3a63fd5f916fbf9ee.png)

Cash Flow Statement What It Is And Examples

Direct Vs Indirect Cash Flow Method Which Is Better

Statement Of Cash Flows How To Prepare Cash Flow Statements

The Statement Of Cash Flows Revisited Ppt Download

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

Direct Vs Indirect Cash Flow Methods Top 7 Differences Infographics

Excel Guide How To Prepare Cash Flows With The Indirect Method Analyst Answers

The Indirect Cash Flow Statement Method

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Cash Flow Statements Explained Blog

Statement Of Cash Flows Answers Questions Such As Ppt Video Online Download